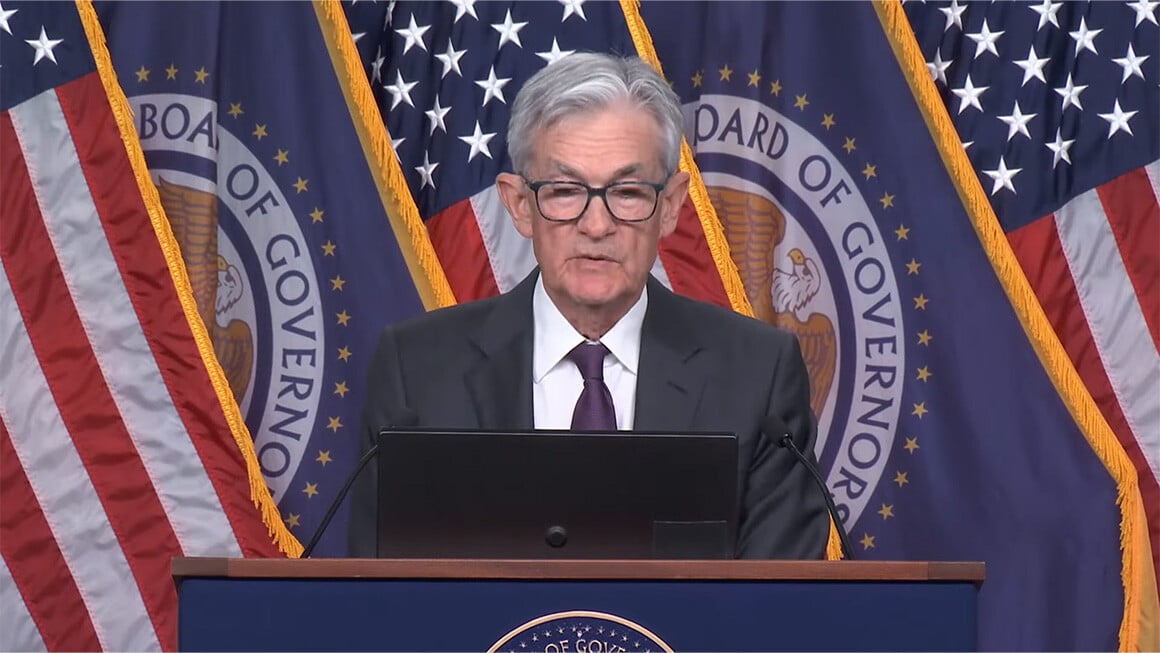

In its January 29, 2025, meeting, the Federal Reserve's Open Markets Committee maintained the federal funds rate at 4.25 to 4.5 percent, citing persistent inflation challenges and a recent uptick in the Consumer Price Index to a 2.9 percent year-over-year increase. Fed Chair Jerome Powell emphasized a cautious approach, stating, "We don’t feel like we need to be in a hurry to make any adjustments."

Ryan Severino, chief economist and head of U.S. research at BGO, expressed concerns that the Fed's current messaging and economic assessments may lead to suboptimal outcomes for commercial real estate investors. He suggests that the central bank's stance could contribute to ongoing uncertainty in the CRE market, potentially affecting investment decisions and market stability.