Commercial Property Executive: Fed Wants Clarity Before Cutting Interest Rates

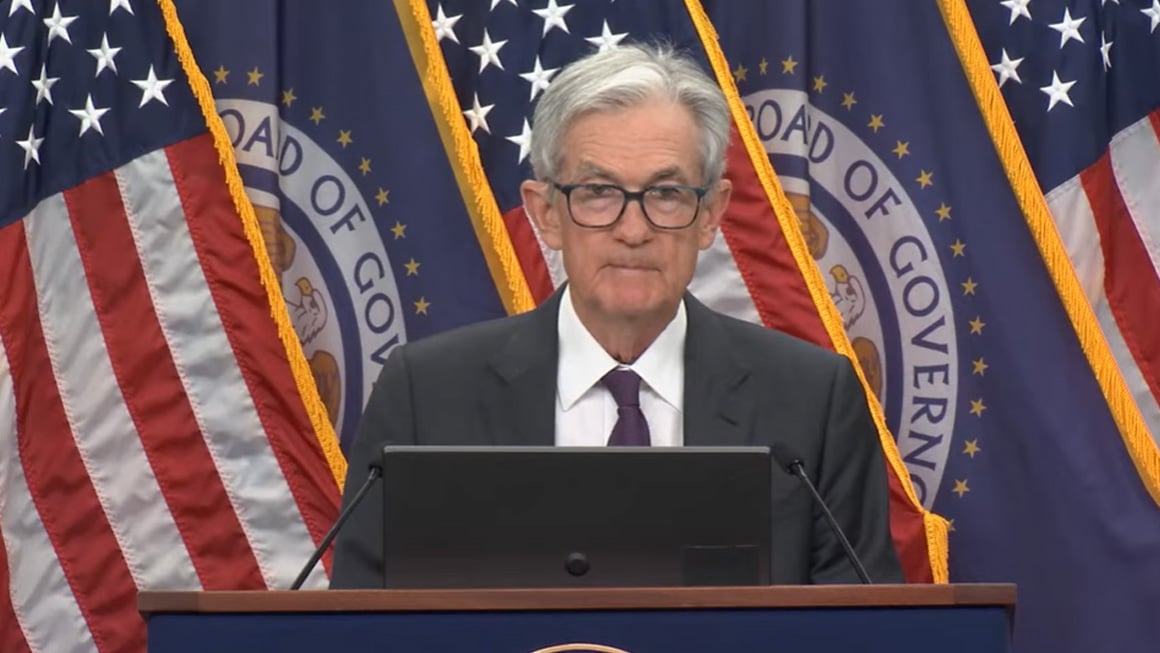

The Federal Reserve held its benchmark interest rate steady at 4.25% to 4.5% following the July 30 FOMC meeting, maintaining a cautious approach as it awaits more clarity on the economy—particularly the effects of tariffs. While inflation hovers just above the 2% target and employment remains strong, Chair Jerome Powell emphasized that the Fed is still balancing evolving risks and remains "well-positioned to learn more" before shifting its policy stance. For now, the central bank is expected to reassess labor and inflation data at its next meeting in September.

The article also includes expert commentary from BGO's Chief Economist and Head of Research, Ryan Severino, who noted that while uncertainty and policy shifts have slowed capital market recovery, they have not stopped it. He expressed that the Fed’s gradual loosening of monetary policy is supporting a modest recovery in commercial real estate. “More than halfway through the year, the recovery is proceeding more slowly than we would like,” he said, “but there is still time on the clock.”